This guide dives into the financial pinch UK households felt during the winter of 2023, with skyrocketing energy bills and what the government’s doing to help ease the pain. It also gives predictions for energy costs in 2024 and shares advice on how to keep those winter expenses down.

Jump to…

- 2023 Struggles, Trends & Highlights

- 2024 Winter Bills Predictions

- Winter Fuel Payment – what is it, and how does it work?

- How to claim the Winter Fuel Payment?

- Cold Weather Payment – what is it, and how does it work?

- Warm House Discount Scheme – what is it, and how does it work?

- How to cut the cost of your Winter Bills!

- How much our members can save…

- Become a member!

Winter in the UK often chills not just the air but also our finances. In 2023, as many of us felt the pinch of winter bills more than ever, it became clear just how significant these financial challenges can be, especially for key workers in the healthcare, education, and care sectors.

Using data from public sources, such as GOV.UK, the Money Charity, GoCompare, and Cornwall Insight, Health Service Discounts, Discounts for Teachers, and Discounts for Carers have created this guide to shed light on the impact of winter 2023, explore how it affected our bills, and look ahead at what’s expected for 2024. Plus, we’re sharing some top tips and handy hacks to help make your winter more affordable.

So, whether you’re looking for ways to save or simply curious about the predicted financial trends, we’ve got you covered. Let’s make this winter a little easier on everyone’s wallet!

2023 Struggles & Highlights

During the winter months of 2023, many families throughout the UK found themselves navigating tight financial waters, largely because of steeper utility bills and the overall climb in living costs.

The cost of gas and electricity hit record peaks, a ripple effect of shifts in global energy markets and hiccups in supply chains. This situation left many homes grappling with how to manage their crucial heating and energy expenses, sparking conversations about maintaining affordability and financial stability in these challenging times. Let’s take a look at some more trends from 2023.

Winter Bills Trends from 2023.

- Energy Price Volatility: Energy price volatility was a central theme affecting households across the UK. On average, a UK household spent £4.17 a day on water, electricity, and gas in December 2023 (The Money Charity). Gas and electricity bills skyrocketed, surpassing previous winter highs and straining household budgets. This trend underscored the vulnerability of consumers to external economic factors beyond their control.

- Impact on Vulnerable Groups: Vulnerable demographics, such as low-income families, elderly individuals on fixed incomes, and those in rural areas reliant on oil heating, were particularly hard hit. Many struggled to heat their homes adequately, facing tough choices between essential expenses like food and heating.

- Government Response and Policy Debate: The government responded with measures such as the Winter Fuel Payment and energy price caps to mitigate the impact on consumers. However, debates persisted over the effectiveness of these measures in addressing long-term energy affordability and sustainability.

- Shift Towards Renewable Energy: The winter of 2023 also saw increased discussions around renewable energy sources as potential long-term solutions to mitigate energy price volatility and reduce reliance on fossil fuels. This shift highlighted a growing awareness of environmental sustainability alongside economic concerns.

- Personal Finance Management: Households adapted by implementing energy-saving measures and seeking financial assistance programs. There was a notable increase in interest towards energy-efficient home improvements and budgeting strategies aimed at reducing overall energy consumption, such as discounts on everyday bills, hacks, and tips.

The winter bills of 2023 in the UK highlighted major financial challenges for households. Rising energy costs caused these challenges, which were worsened by broader economic factors. The observed trends emphasise the necessity for sustainable energy solutions and strong support systems to improve financial resilience among vulnerable groups.

Winter Bills 2024: What to Expect

The trends from 2023 highlighted a want and need for sustainable solutions and ways to cut the cost of bills. With this in mind, many are looking forward to this year’s winter to predict and prepare for what i to come.

Based on the data from 2023, it’s fair to say that bills have been all over the place. While there are no concrete predictions, we can make some educated guesses based on the data available to us.

Prepaid Gas and Electricity | Energy Bills dropped by 7% on July 1, 2024

One thing that is clear going into winter 2024 is that it’s essential to monitor prepaid gas and electricity costs. Prepayment meters enable you to pay for your energy usage in advance. This means you can manage your budget more effectively by topping up your meter as needed. It’s a convenient and straightforward way to ensure you always stay on top of your energy bills.

For the third quarter of 2024, the price limit set by Ofgem will go down to £1,568 per year for average gas and electricity use, a cut of 7% from the current £1,690. But this might not last; experts from Cornwall Insight predict expenses will rise again to £1,762 starting in October and stay that way into January 2025.

Energy Prices | Will they fall?

Craig Lowrey of Cornwall Insight noted that fears of energy bill spikes due to Red Sea events were unfounded. Current trends suggest prices might decrease, thanks to strong energy reserves and supply outlooks. Despite this, a return to pre-crisis levels is unlikely soon due to shifts in Europe’s energy sourcing and geopolitical tensions, suggesting higher costs may become the new norm for households.

The path to lower UK energy costs lies in reducing dependency on imported energy and focusing on domestic renewable sources, aiming for a more stable and sustainable energy future.

Why have prices for energy bills been rising?

As outlined by GoCompare, soaring energy bills have primarily been triggered by the Russia-Ukraine conflict starting in February 2022. Russia’s reduction in gas exports to Europe caused a significant spike in European natural gas prices, affecting global rates due to Europe’s urgent search for alternative energy sources. Although the UK’s direct reliance on Russian gas was minimal, it’s still tied to the European market, which heavily depended on Russia for gas, leading to increased energy costs in Britain.

Prices have seen a dramatic rise; for instance, UK gas prices leapt from 38p per therm at the beginning of 2021 to 537p per therm by August 2022, causing numerous UK energy firms to collapse. A large portion of British homes relies on gas heating, more so than in France or Germany, and gas-fired power plants generate about 40% of the UK’s electricity.

Despite a drop in wholesale prices, they spiked again due to the Israel-Gaza conflict out of concern it might escalate, impacting Middle Eastern gas supplies. However, prices stabilised as those fears diminished, and there’s optimism that Red Sea tensions won’t escalate energy costs further.

Will energy prices begin to go down in 2024?

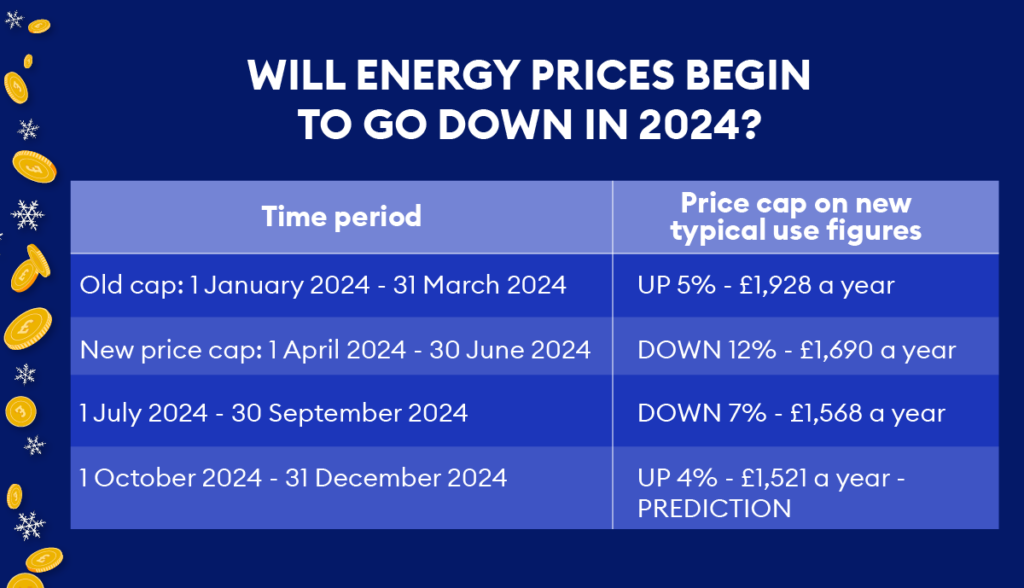

Electricity and natural gas are key to powering our homes and offices, but their prices often change over the year. To help us plan for 2024, Cornwall Insights has analysed the latest trends and made predictions about energy usage and costs, focusing on how price limits might adjust.

They’ve provided a handy table with estimated future costs and price cap forecasts. Price caps are important because they prevent sudden large increases in energy bills by setting a maximum charge per unit of energy.

This information is crucial for anyone looking to budget their household expenses or for businesses planning their operational costs. By understanding these predictions, you can better prepare for any changes in your energy bills, ensuring no surprises come your way.

What the Winter Fuel Payment, and how does it work?

The Winter Fuel Payment is an annual, tax-free payment for households with someone born on or before September 22, 1958 (for 2024-25). Its purpose is to assist eligible individuals with heating costs during the winter months.

How to Claim the Winter Fuel Payment?

As outlined by AgeUK, if you receive the State Pension or certain benefits, you’ll automatically get extra payments, excluding if you only get Housing Benefit, Council Tax Support, Child Benefit, Universal Credit, or if you’ve deferred your State Pension. If you don’t automatically qualify, perhaps because you’re abroad or don’t receive these benefits but are eligible for the Winter Fuel Payment, you’ll need to apply yourself.

Please note that the Winter Fuel Payment future is currently uncertain due to the government changes in policy, so if you have any questions or concerns, call the helpline. When you contact the Winter Fuel Payment Centre, make sure you have the following information at hand;

- your name

- your address

- your date of birth

- your National Insurance number

If you’re in the UK

- Telephone: 0800 731 0160

- Textphone: contact Relay UK on 18001 then 0800 731 0160

- British Sign Language (BSL) video relay service if you’re on a computer – find out how to use the service on mobile or tablet

- Monday to Friday, 8am to 6pm

- Find out about call charges

If you’re outside the UK

- Telephone: +44 (0)191 218 7777

- Textphone: contact Relay UK on +44 (0)151 494 2022 then 0800 731 0160

- British Sign Language (BSL) video relay service if you’re on a computer – find out how to use the service on mobile or tablet

- Monday to Friday, 8am to 6pm

- Find out about call charges

Winter Fuel Payment Centre

Mail Handling Site A

Wolverhampton

WV98 1Z

Cold Weather Payment – what is it, and how does it work?

The Cold Weather Payment is designed to help individuals who are financially impacted by severe cold temperatures. Those receiving certain benefits or mortgage support may qualify for this assistance.

Importantly, receiving a Cold Weather Payment will not influence the amount of other benefits you receive. It’s important to distinguish this from the Winter Fuel Payment, which is a separate form of support.

Eligibility for the Cold Weather Payment depends on the average temperature in your area, which is determined by actual temperatures or forecasts. If you qualify, you will receive £25 for every 7-day period of very cold weather from November 1, 2024, to March 31, 2025, as indicated on the official government website.

Warm House Discount Scheme – what is it, and how does it work?

The Warm Home Discount scheme will reopen in October 2024, providing a one-off £150 discount on your electricity bill. Rules and factors must be considered to determine your eligibility.

If you are eligible, you usually receive the discount automatically, so you don’t have to do anything. The money is not paid to you but to your bill supplier. You may also get a discount on your gas bill if your supplier provides you with both gas and electricity.

Debt and Savings – What You Need to Know!

Navigating and handling debt is becoming increasingly challenging, especially with the aftermath of the pandemic and the current cost-of-living crisis. It’s quite understandable that many people are now leaning on extra borrowing to cope with daily financial hurdles.

As of October 2023, The Money Charity stated that the amount of outstanding consumer credit surged to £219.4 billion, marking a substantial increase of £962 million compared to September 2023’s figures. This significant growth underscores the escalating reliance on consumer lending, prominently driven by the necessity to manage winter-related financial burdens.

Fast forward a couple of months, and it is clear that the UK’s financial stats haven’t improved much. In The Money Charity’s July Report of 2024, they spotlight key figures.

- £65,239 Average total debt per UK household in May 2024

- £2,487 Average credit card debt per household in May 2024

- 6.92% Change in outstanding credit card balances in year to May 2024

- £4,264 Total unsecured debt per UK adult in May 2024

With these figures in mind, it is clear that Winer 2024 is predicted to be another financially challenging period, especially for vulnerable demographics, such as low-income families, elderly individuals on fixed incomes, those in rural areas, and key workers.

How to Cut the Cost of Your Winter Bills in 2024

If you’re feeling the pinch financially and want to ease the burden for winter 2024, here are some valuable tips. Last year, the average household in the UK looked for ways to cut down on expenses. This included saving on utility bills (like gas and electricity), grocery shopping, luxury items, and even Christmas purchases.

For those working in the healthcare sector, there’s good news. You can access discount schemes specifically designed for you, such as Health Service Discounts. This is the biggest free discount program available to NHS and healthcare staff, offering exclusive deals to help you save money without spending a penny.

How much our members can save…

In 2023, on average, our members saved;

- £259 on Groceries

- £214 on Utility Bills

- £186 on Mobile & TV

- £2262* annually across various categories, including fashion, travel, household bills and much more.

Joining is free, and there are no fees to use the discounts available. If you’re interested in saving even more, you might consider the optional ode cashback card. It’s free for the first year and then costs just £2.99 a year afterwards. However, staying with just the free deals and discounts is perfectly fine, too. The cashback card is an additional way to stretch your budget further, but it’s completely optional.

Sources

- Cornwall Insight | Dr Craig Lowrey

- Energy Live News | Energy price cap down 7%

- GoCompare | Will Energy Prices Go Down?

- GOV.UK | Cold Weather Payment

- GOV.UK | Warm Home Discount Scheme

- GOV.UK | Winter Fuel Payment

- The Money Charity | Statistics

How to Sign Up for FREE

Health Service Discounts is a FREE to-join and FREE-to-use discount scheme for NHS & Healthcare Staff that has been around for 20+ years. We’re all about making your life a little lovelier with our money-saving offers.

More From Us

If you enjoyed this blog, then make sure you check out more from us. We have a variety of blogs for you to enjoy, from Top 5 Places to be a Nurse, Money Saving Travel Hacks, to Tips to Save on Your Weekly Food Shop.

Check out our blog regularly so you never miss out.